How to Dispose of Old Business Records Securely

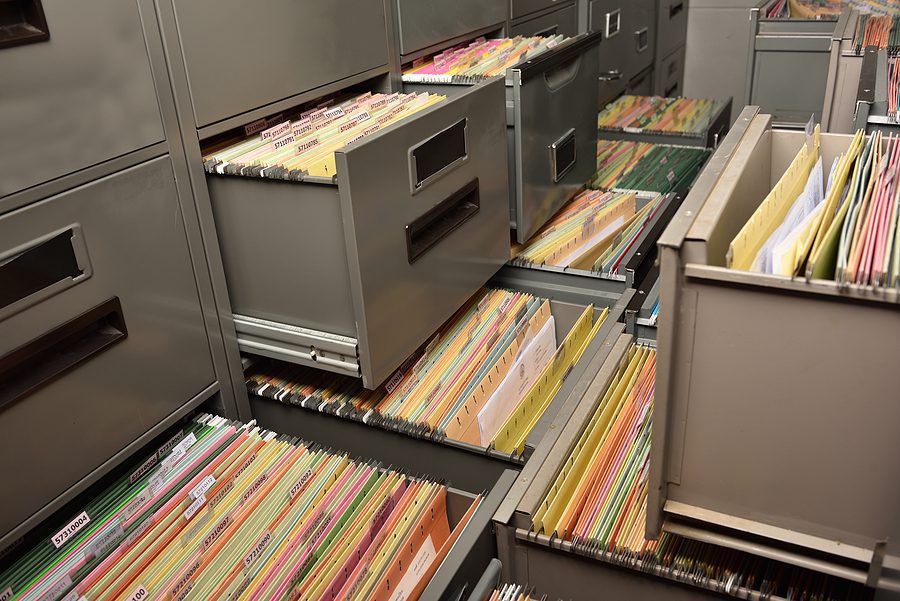

Your business will accumulate paperwork quickly. Employee information, tax papers, financial statements, business records, and much more will fill your filing system quickly. These days, many companies chose to scan certain paperwork, but even electronic information will accumulate. To keep your data secure, it’s important to know both how long to keep business records, and how to dispose of them when you need to.

Data Protection Concerns with Old Business Records

Whenever you have sensitive information, there are data protection concerns. If you have financial or other business data in a filing cabinet or on your hard drive, there is a risk that it could be compromised. Hard drives can fail, hard copies can fall victim to fire or water damage, and there is always the risk of theft. Because there are data protection concerns with storing old records, it’s important to only keep what you need.

How Long to Keep Old Business Records

Whether your business records are hard copies or electronic files, you need to consider how long you need to keep these records. Consulting with your attorney or tax professional is a good way to know what you should keep and what you can dispose of.

Business Tax Returns and Supporting Documents

Generally speaking, the IRS recommends that you keep these documents for 7 years. This is because there is a “period of limitations” during which a tax return can be amended by you or challenged by the IRS, and this period is usually six years from filing. However, even though you may be able to dispose of supporting documents after 7 years, it may make sense to keep a final copy of your business tax returns and correspondence with the IRS to assist in preparing future returns.

Employment Tax Records

The IRS suggests that you retain any records pertaining to employee taxes for a minimum of 4 years after the date these taxes were due or paid. These include your EIN, wages, pension payments, the personal information of your employees, and anything else pertaining to employment taxes.

Business Property

If you no longer own the asset, you should keep the records until the period of limitations ends. Any deeds and titles need to be kept until you sell or dispose of the property.

Business Ledgers

Your CPA will advise you on how long to keep profit and loss statements, financial statements, check registers, annual reports, Board of Directors information, annual meeting minutes, business formation documents, invoices and expense reports, and corporate by-laws. A minimum of 7 years is the conservative recommendation.

Banking Information

If the records are used for tax purposes, the 7 year recommendation makes sense. But if the statements have no tax implications, monthly bank statements can be disposed of after a year.

How to Dispose of Old Business Records

When it’s time to dispose of old business records, you want to make sure that they are destroyed and cannot be retrieved and stolen. There are reputable companies who can assist with shredding of hard copies much more efficiently and securely than your office shredder can, and some are also able to destroy the hardware itself when you need to dispose of electronic data.

You don’t want to take a chance when it comes to crucial information about your business. Speaking with financial and legal experts can help you decide what to keep and what to destroy, and shredding companies, like AccuShred, can ensure that when you’re ready to dispose of old records in the name of data protection, the job is done right. Contact us today to learn more.